As cryptocurrency becomes increasingly mainstream in the United States, tools that help investors analyze markets, execute trades, and grow their portfolios have never been more essential. Whether you’re a seasoned trader or a crypto-curious beginner, having the right set of tools at your fingertips can significantly influence your success. Here’s a breakdown of the top-rated crypto tools that American investors are tapping into for smarter, more efficient digital asset management.

Analysis and Research Tools

Before making any trading decision, thorough analysis is key. These platforms provide crucial insights into market trends, on-chain activity, and crypto fundamentals.

- CoinMarketCap – One of the most well-known crypto data aggregators, CoinMarketCap offers real-time price tracking, historical charts, market caps, and more. It’s a reliable starting point for anyone trying to gauge the health of a specific token.

- Glassnode – A favorite among data-driven investors, Glassnode offers on-chain analytics including wallet address activity, exchange inflow/outflows, and HODL behavior patterns.

- Messari – With in-depth project research, sector-specific newsletters, and robust data visualizations, Messari is a go-to for fundamental analysis and technical reporting.

Trading Platforms and Tools

For those actively trading crypto assets, a fast, reliable, and feature-rich platform is vital. These tools not only facilitate trades but also offer complex charting and risk-management options.

- Binance.US – Affordable trading fees, robust liquidity, and a wide array of altcoins make Binance.US appealing for active American traders. It also includes features like staking and recurring buys.

- Coinbase Pro – A favorite for its security and ease-of-use, Coinbase Pro markets itself to intermediate traders seeking both functionality and clarity.

- TradingView – While not a trading platform per se, TradingView is a powerful charting tool that integrates with several exchanges. It provides custom indicators, strategy backtesting, and community-driven insights.

Bonus Tip: Pairing TradingView with Binance.US or Coinbase Pro creates a seamless experience for technical traders who rely on visual tools to track market movements.

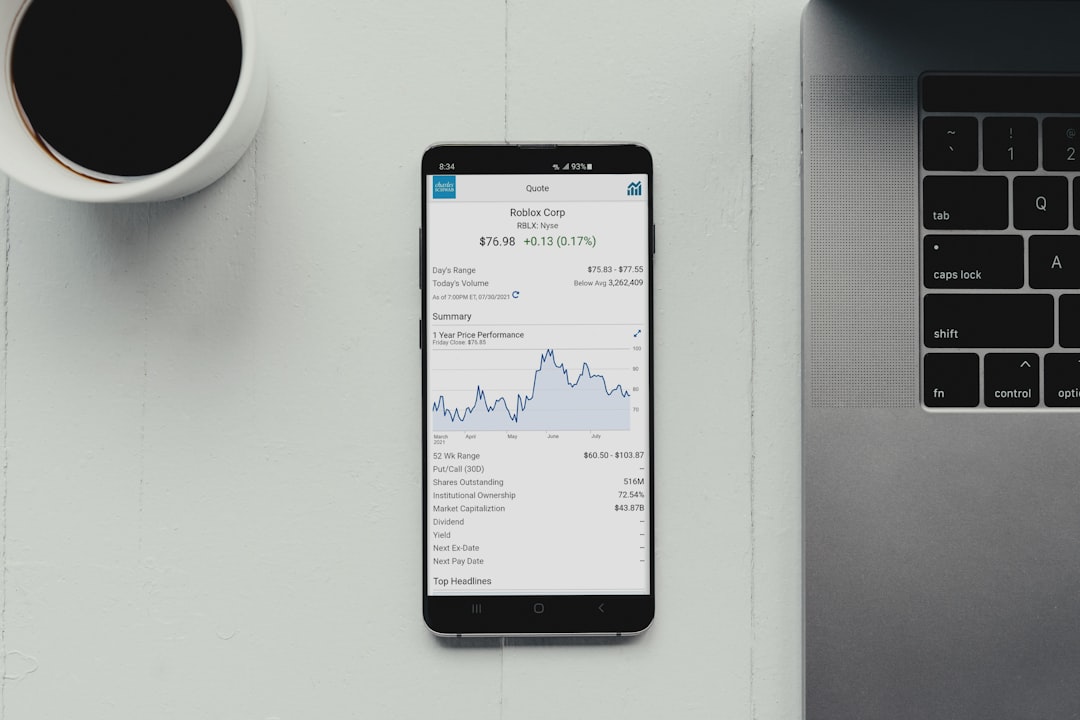

Portfolio Tracking and Management

Once assets are purchased and distributed across wallets or exchanges, keeping track of your portfolio can become challenging. That’s where these tools come into play.

- CoinStats – Offering both mobile and desktop versions, CoinStats lets you manage and track your entire portfolio connected via API or manual entry from multiple wallets and exchanges.

- Zerion – A dedicated DeFi portfolio tracker, Zerion is perfect for users engaged in yield farming, liquidity pools, and NFTs across Ethereum-based protocols.

- Delta – This investment tracker supports a wide range of assets beyond crypto, including stocks and ETFs, ideal for diversified investors.

Security and Wallet Management

Security remains a top concern for all crypto investors, especially in the USA where regulations are evolving. These wallets and tools offer safeguards and user experience that cater to both newcomers and pros alike.

- Ledger Nano X – As one of the most secure hardware wallets, Ledger lets you physically store your cryptocurrency offline, reducing the risk of hacks.

- MetaMask – Beyond being a browser extension wallet, MetaMask gives users access to decentralized apps (dApps), NFT platforms, and DeFi protocols in seconds.

- Trust Wallet – A mobile-first wallet that supports a wide range of coins and tokens and integrates directly with Binance DEX and staking platforms.

Educational and News Platforms

Staying informed is half the battle in the fast-moving world of cryptocurrencies. The following platforms provide trusted news and educational content to empower better investing decisions.

- CoinDesk – A pioneer in crypto journalism, CoinDesk delivers up-to-date news, podcasts, and opinion pieces that reflect the latest market happenings and policy changes.

- The Block – Known for its deep-dive analyses and investigative reporting, The Block provides high-level coverage of trends, enterprise blockchain, and DAO governance.

- Crypto Twitter and Reddit (r/CryptoCurrency) – Not traditional media, but real-time updates and user commentary found here often uncover opportunities long before mainstream outlets catch on.

In Summary

With the right combination of analysis tools, trading platforms, portfolio trackers, and educational resources, American crypto investors can step confidently into this dynamic space. The tools listed above are not just popular—they’re vetted by communities, tailored for growth, and essential for navigating the increasingly-complex crypto ecosystem.

Each investor’s strategy may differ, but integrating several of these top-rated resources will undoubtedly provide a clearer path toward profitability and security in the evolving crypto landscape.