As the world continues shifting toward digital commerce, businesses are left with critical financial decisions to make. One of the most fundamental choices is how to handle accounting and bookkeeping. Should your business adopt a traditional accounting system or switch to ecommerce-specific bookkeeping? The answer isn’t always straightforward, as each approach comes with its own benefits, challenges, and suitability based on business structure. This article dives into the key differences, pros and cons, and how to decide which method best fits your business.

Understanding the Basics

Before comparing the two, it’s essential to understand what traditional accounting and ecommerce bookkeeping each entail.

Traditional Accounting

Traditional accounting refers to the established system of managing financial records, including tracking income, expenses, assets, liabilities, and taxes. It is based on double-entry bookkeeping principles and typically involves:

- Manual or software-assisted ledger entries

- Invoicing and bill payment

- Bank reconciliation

- Financial statements generation (P&L, balance sheet, cash flow)

- Tax preparation and compliance

This method is commonly used by brick-and-mortar businesses or service-based companies that have relatively straightforward income and expense streams.

Ecommerce Bookkeeping

Ecommerce bookkeeping is tailored for online businesses that sell goods or services through platforms like Amazon, Shopify, Etsy, or WooCommerce. It addresses the complexities that arise from selling products online, such as:

- Tracking multichannel sales and fees

- Managing inventory and cost of goods sold (COGS)

- Handling refunds and chargebacks

- Sales tax compliance across multiple jurisdictions

- Syncing with ecommerce platforms and payment gateways

Ecommerce bookkeeping uses cloud-based automation tools and real-time data integrations to reduce the margin of error and time spent tracking transactions from multiple online sources.

Key Differences Between Ecommerce Bookkeeping and Traditional Accounting

Though both aim to keep business finances in order, there are several notable differences:

| Feature | Traditional Accounting | Ecommerce Bookkeeping |

|---|---|---|

| Sales Channels | Primarily physical or service-based transactions | Multiple online platforms and payment processors |

| Inventory Tracking | Manual or single-location inventory management | Dynamic stock levels, dropshipping complexities, COGS calculations |

| Sales Tax | Local and state tax rules | Multistate or international tax compliance |

| Automation | Lower unless using robust accounting software | High automation, built-in integrations with ecommerce tools |

Ecommerce bookkeeping is inherently more agile and equipped to handle the nuances that come with online sales. But does that mean traditional accounting is obsolete? Not necessarily.

When Traditional Accounting Is a Better Fit

Traditional accounting continues to be a cornerstone for many types of businesses. It may be the better choice if your business:

- Operates primarily through in-person sales or consulting services

- Has straightforward transactions and minimal inventory

- Employs an in-house bookkeeping team using desktop software

- Needs custom financial reporting or audits outside ecommerce metrics

- Deals with long-term contracts or recurring billing models

For example, a law firm, dental office, or construction company will rarely benefit from ecommerce-specific tools that deal with SKU tracking or marketplace syncing. In these cases, the simplicity and formality of traditional accounting are not just sufficient—they’re optimal.

When Ecommerce Bookkeeping Shines

If your business operates online, ecommerce bookkeeping is not a luxury—it’s a necessity. Here’s where it outperforms traditional methods:

- Multi-platform sales: Tracks purchases made across Amazon, eBay, Etsy, etc.

- Real-time data: Enables you to upload and sync information instantly

- Automation: Reduces time spent on manual entries and reconciliations

- Advanced reporting: Offers insights on sales trends, return rates, and profit margins

- Sales tax compliance: Automatically calculates tax according to location regulations

Consider a business selling handmade jewelry through Shopify with occasional wholesale deals. Without a system to track inventory, shipping costs, and marketplace commissions, understanding profitability becomes difficult. Ecommerce bookkeeping solutions like A2X, QuickBooks Commerce, or Xero integrations make this process seamless and accurate.

The Role of Software in Both Systems

Software plays a pivotal role in streamlining financial processes. In traditional accounting, tools like QuickBooks Desktop or Sage are commonly used. They require manual entry of transactions, which might be fine for low-volume businesses.

In contrast, ecommerce bookkeeping thrives in the cloud. Platforms like:

- QuickBooks Online – Integrates directly with ecommerce platforms

- Xero – Cloud-based with bank feeds and customizable dashboards

- A2X – Automates Amazon and Shopify sales reconciliation

- TaxJar – Calculates and files sales tax automatically

These tools don’t just reduce bookkeeping time; they improve accuracy and give business owners real-time insight into financial health.

Cost Considerations

Cost is another crucial factor when deciding between traditional and ecommerce accounting methods. Traditional systems may require:

- Monthly software licenses

- Hourly rates for accountants

- Setup costs for transitioning from paper records

Ecommerce bookkeeping, while generally more automated, also isn’t free. Most platforms operate on monthly subscription models based on sales volume. You might also pay for additional integration tools and cloud services.

However, the question is not what costs less, but what delivers greater value for your specific business operations. For an ecommerce business, using a traditional accounting method may actually cost more in human hours and lost accuracy.

Beyond the Balance Sheet: Strategic Decision-Making

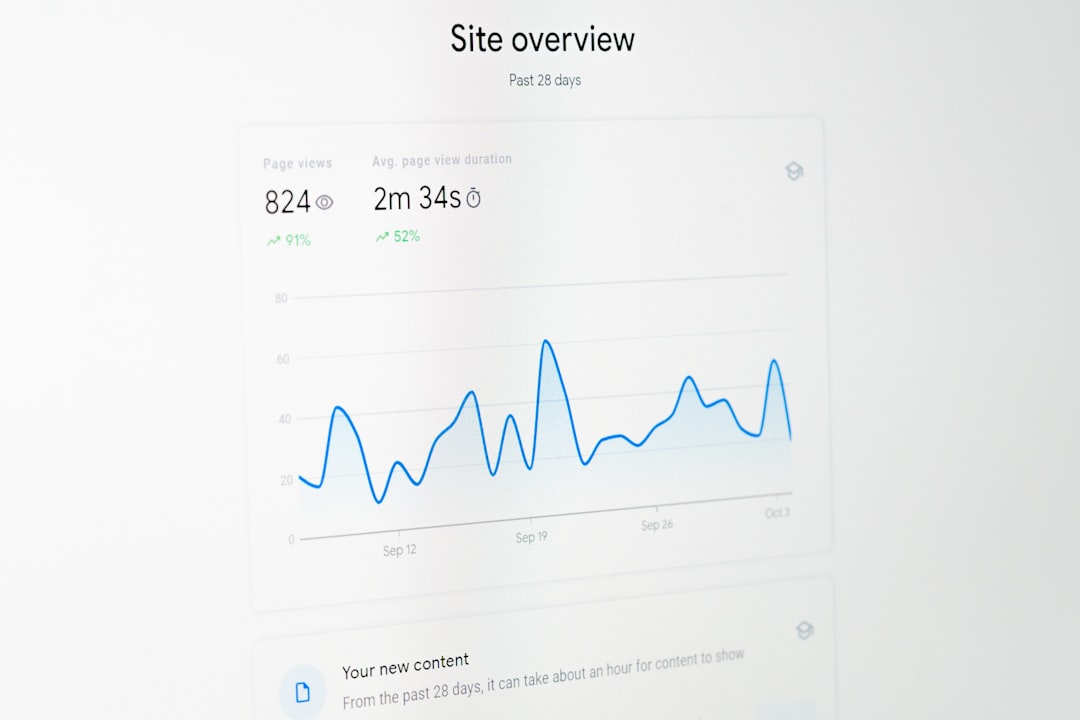

Your financial system should not only help you stay compliant but also fuel smarter decision-making. Ecommerce bookkeeping facilitates this in ways traditional accounting often doesn’t. Dashboards and visualizations allow online sellers to:

- Identify best-selling products

- Forecast cash flow based on seasonal demand

- Predict inventory restocking needs

- Track marketing ROI and customer acquisition costs

Data-driven operations are the backbone of ecommerce success, and if your business needs those insights, then choosing traditional accounting could leave you flying blind.

Conclusion: Which One Is Right for You?

Choosing between ecommerce bookkeeping and traditional accounting depends on your business model, growth level, and operational complexity. Ask yourself the following questions:

- Is your business primarily online or physical?

- Do you sell products, services, or both?

- How complex is your inventory and order system?

- Do you need real-time data reporting?

- Are you struggling with sales tax across regions?

If most of your answers favor digital operations, ecommerce bookkeeping is your best ally. It’s designed to handle the scalability and complexity of online selling. On the other hand, if your business operates at a local level with a low volume of transactions, traditional accounting may be sufficient and more cost-effective.

In an ideal scenario, businesses evolve their accounting strategy as they grow. Starting with traditional accounting and migrating toward ecommerce bookkeeping can be a natural progression for businesses entering online markets.

Either way, ensuring that your financial records are accurate, timely, and insightful is non-negotiable. Whether you’re a storefront or a seller in the cloud, the tools you use must match the way your business operates.