As the digital asset landscape evolves rapidly, crypto in 2025 stands at a crossroads: will it emerge as a mainstream technology with real-world utility, or continue to ride the waves of speculation and hype? With recent developments in regulation, infrastructure, and corporate adoption, experts and enthusiasts alike are watching closely to determine the trajectory of this transformative sector.

The Shift from Speculation to Utility

In the early days, cryptocurrencies such as Bitcoin were primarily viewed as speculative investments — vehicles for high risk and high reward. The promise of decentralization and freedom from traditional banking systems attracted investors who were more interested in price movements than in the technology’s potential applications.

Fast forward to 2025, and the market reveals a more nuanced story. Major players, including governments and multinational corporations, are exploring blockchain technology for real-world use cases:

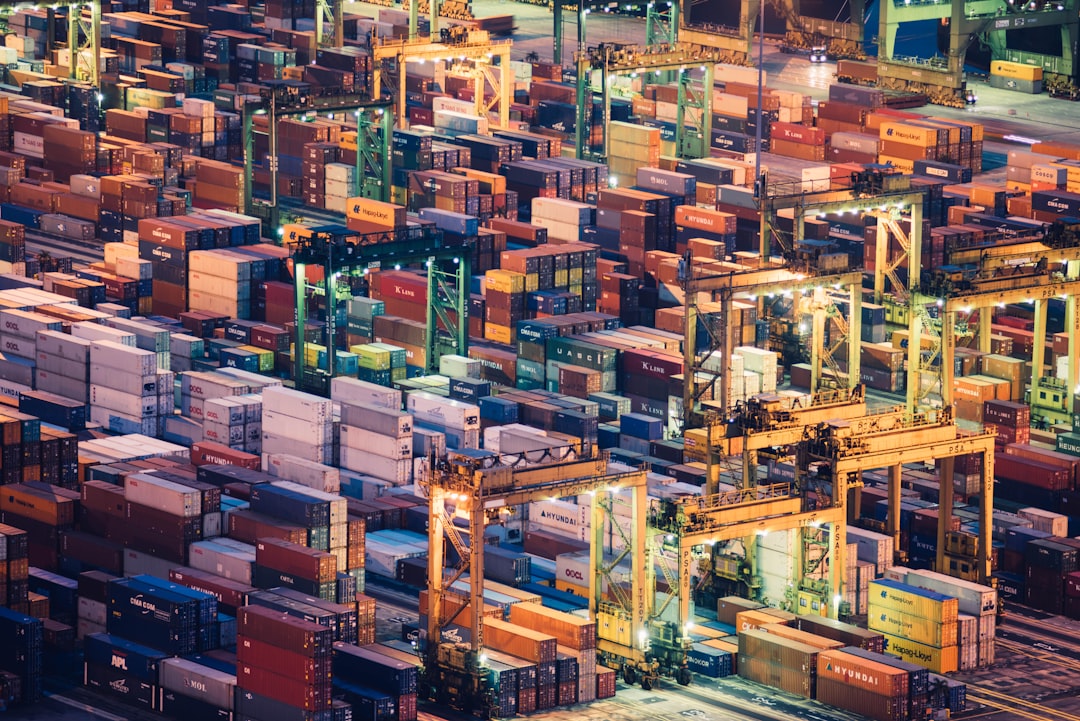

- Supply chain management: Blockchain provides transparent and immutable ledgers that enhance traceability and efficiency.

- Decentralized finance (DeFi): Platforms are offering lending, borrowing, and yield farming without intermediaries.

- Tokenization of assets: Real estate, art, and even stocks are being digitized into tradeable tokens.

- Cross-border payments: Cryptocurrencies are enabling faster and cheaper international transactions.

These applications signal a maturing ecosystem, aiming to move beyond the hype cycles.

Regulatory Clarity: A Turning Point

Regulatory clarity has been one of the linchpins in moving the crypto sector toward legitimacy. As of 2025, several jurisdictions, including the European Union and parts of Asia, have implemented robust frameworks for digital assets. This offers a safer environment for both individual users and institutional investors while deterring malicious actors from preying on unregulated markets.

However, regulation remains a double-edged sword. While it brings clarity and encourages adoption, heavy-handed policies can stifle innovation. The United States, for example, continues to walk a fine line between promoting innovation and enforcing security laws.

Corporate Adoption and Mainstream Integration

The true test of crypto’s utility in 2025 lies in its integration into daily business and consumer activity. Major tech giants and financial institutions are already leveraging blockchain for various processes. Consumers are now able to purchase goods with stablecoins, launch decentralized applications (dApps), and even earn income through play-to-earn gaming, all possible due to evolving blockchain structures.

Additionally, Web3 continues to drive user ownership and control. From decentralized identity systems to NFT-based ticketing, the world is slowly adopting crypto-based models not just for investment, but for meaningful functions that solve real-world problems.

The Skeptic’s View: Hype Still Persists

Despite major advancements, skepticism persists. Critics argue that many applications lack clear business models or are solutions in search of a problem. Rug pulls, scams, and pump-and-dump schemes still plague the industry, making it hard for the average individual to trust digital assets.

Moreover, crypto volatility continues to be a roadblock to widespread adoption. While stablecoins attempt to address price instability, regulatory scrutiny and operational risks remain constant concerns.

The Road Ahead

Crypto in 2025 presents a complex picture. It’s neither a complete revolution nor a dying fad; rather, it’s an innovative but still-maturing technology. The key differentiator between hype and utility will be the quality of its integration into real-life systems — and the resolve of developers, regulators, and users to focus on sustainable growth.

For now, the technology holds immense promise, but realization depends on continued improvements in scalability, security, and user experience.

Frequently Asked Questions (FAQ)

- Q: Is cryptocurrency widely accepted for payments in 2025?

A: While adoption is growing, cryptocurrency is still not universally accepted. However, certain industries and regions have seen significant increases in crypto-based transactions. - Q: What are the safest cryptocurrencies to use or invest in?

A: Stablecoins like USDC and regulated digital assets are considered lower risk, but it’s essential to conduct thorough research and consider the role of regulation and security. - Q: Are NFTs still popular or have they faded away?

A: While the speculative bubble around NFTs has cooled, they are still being actively used in fields like digital identity, gaming, and event ticketing. - Q: Is DeFi safe to use in 2025?

A: DeFi protocols have improved in terms of auditing and security, but users must remain cautious and do their own due diligence. - Q: How are governments responding to the growth of cryptocurrencies?

A: Responses vary by country—some foster innovation through supportive regulation, while others impose stricter controls or seek to introduce Central Bank Digital Currencies (CBDCs).